In today’s competitive business world, it is essential for entrepreneurs and small business owners to carefully consider the type of legal structure that best suits their needs. One popular option is the Limited Liability Company (LLC). Understanding the advantages and disadvantages of forming an LLC can help you make an informed decision about whether it is the right choice for your business.

Understanding LLCs

Definition of an LLC

An LLC, short for Limited Liability Company, is a popular business structure that combines the benefits of a corporation and a partnership. This hybrid entity provides its owners, known as members, with limited liability protection, shielding their personal assets from the company’s debts and liabilities. At the same time, an LLC offers flexibility in management and taxation, making it an attractive option for many entrepreneurs.

One key feature of an LLC is its pass-through taxation, where the company’s profits and losses are passed through to the members’ personal tax returns. This can lead to potential tax savings and simplifies the overall tax process for the business.

The Formation of an LLC

When forming an LLC, there are several important steps to follow to ensure compliance with legal requirements. Firstly, you must choose a unique name for your company that complies with state regulations and accurately reflects your business. Next, you will need to file the necessary formation documents, such as Articles of Organization, with the appropriate state agency, typically the Secretary of State’s office. These documents will outline key details about your LLC, including its name, address, members, and purpose.

Additionally, it is essential to create an operating agreement for your LLC. This internal document lays out the ownership structure, management responsibilities, decision-making processes, and profit-sharing arrangements among the members. While not always required by law, having an operating agreement in place can help prevent misunderstandings and conflicts in the future, ensuring the smooth operation of the business.

The Advantages of an LLC

Limited Liability Protection

One of the primary advantages of forming an LLC is the limited personal liability it offers. Unlike sole proprietorships and partnerships, where owners are personally responsible for the business’s debts and legal obligations, an LLC shields its members from personal liability. This means that members’ personal assets, such as their homes and savings, are generally protected.

Furthermore, limited liability protection extends to the actions of other members within the LLC. This means that if one member engages in misconduct or accrues debts on behalf of the LLC, the personal assets of other members are typically not at risk. This safeguard can provide peace of mind to individuals looking to start a business without putting all their personal assets on the line.

Flexibility in Management

LLCs provide flexibility in terms of management structure. Unlike corporations, which have a strict hierarchy and must hold regular meetings, LLCs can choose to be member-managed or manager-managed. Member-managed LLCs allow all members to participate in decision-making, while manager-managed LLCs designate a few members or even non-members to handle day-to-day operations.

Moreover, within the realm of member-managed LLCs, there is the option to operate as either single-member or multi-member LLCs. Single-member LLCs are owned and operated by one individual, providing simplicity in decision-making and management. On the other hand, multi-member LLCs involve two or more owners who share responsibilities and decision-making power, fostering collaboration and diverse perspectives in running the business.

Profit Distribution

LLCs offer flexibility in profit distribution. By default, profits are distributed based on each member’s ownership percentage. However, LLCs can also choose to distribute profits in a manner that is different from ownership percentages, allowing for customized profit-sharing arrangements.

Additionally, LLCs have the flexibility to retain profits within the business for future growth and investment. This ability to reinvest profits can be advantageous for businesses looking to expand operations, develop new products or services, or weather economic downturns. By retaining earnings, LLCs can strengthen their financial position and enhance long-term sustainability.

The Disadvantages of an LLC

Self-Employment Taxes

While an LLC provides limited liability protection, members are subject to self-employment taxes. This means that they must pay both the employer and employee portions of Social Security and Medicare taxes on their share of the business’s profits. Depending on the amount of profit generated, these taxes can be substantial.

Limited Growth Potential

Compared to corporations, LLCs may face limited growth potential. For example, it can be more challenging for an LLC to attract venture capital funding or issue shares of stock to raise capital. Additionally, some states have restrictions on the types of businesses that can be formed as LLCs.

More Paperwork and Formalities

As compared to sole proprietorships and partnerships, LLCs require more paperwork and formalities. This includes keeping thorough business records, filing annual reports with the state, and complying with other administrative obligations. While these requirements are generally not overly burdensome, they do require ongoing attention and organization.

Lack of Perpetual Existence

Unlike corporations, which have perpetual existence, LLCs may face challenges in terms of continuity. In the event of a member’s death or departure, the LLC may need to be dissolved or restructured, which can lead to disruptions in business operations and potential legal complexities. This lack of perpetual existence can make long-term planning and stability more difficult for an LLC.

Complex Decision-Making Processes

Due to the structure of an LLC, decision-making processes can sometimes be more complex and time-consuming compared to other business entities. In an LLC, major decisions often require the consensus of all members, which can lead to disagreements and delays in implementing strategic initiatives. This collaborative decision-making approach, while beneficial in some aspects, can also hinder agility and quick decision-making in certain situations.

Choosing the Right Business Structure

Factors to Consider

When deciding which legal structure is best for your business, several factors should be taken into account. These include the nature of your business, the level of personal liability you are comfortable with, the desired management structure, the tax implications, and the potential for future growth. Consulting with a legal and tax professional can help you evaluate these factors and make an informed decision.

It’s crucial to consider the nature of your business when selecting a legal structure. For example, if you are running a small, family-owned business, a sole proprietorship might be a suitable option due to its simplicity and ease of setup. On the other hand, if you are planning to attract outside investors and eventually go public, a corporation might be more appropriate to accommodate future growth and expansion.

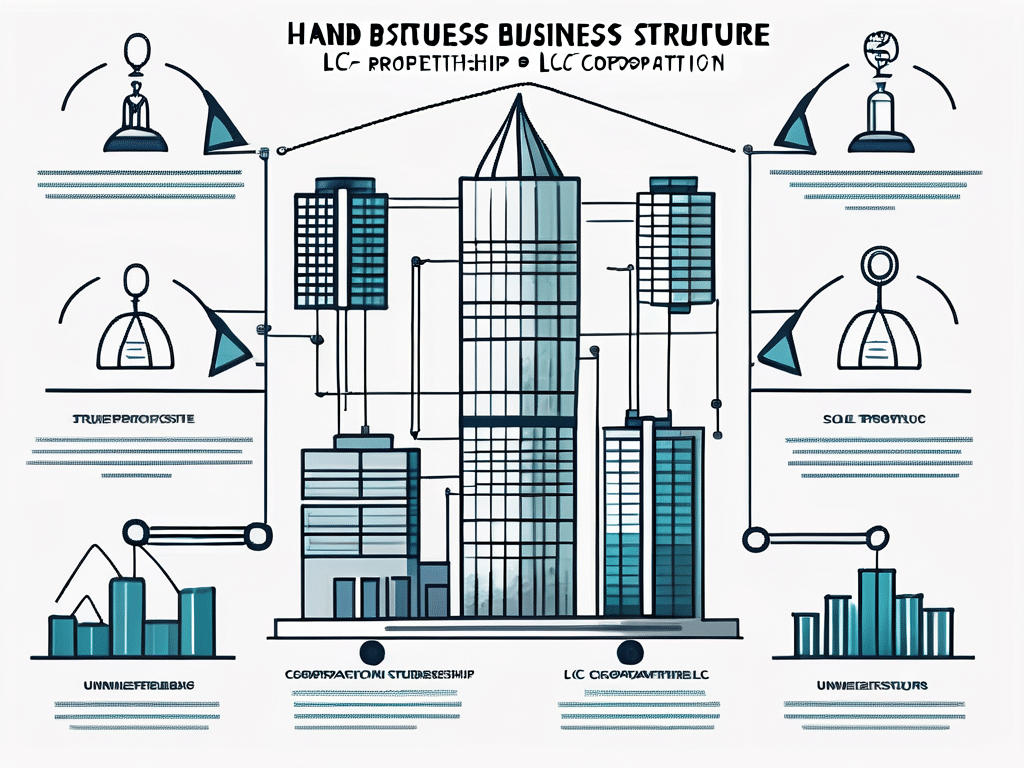

Comparing LLCs to Other Business Structures

LLCs are just one of several options available when it comes to choosing a legal structure for your business. Other common options include sole proprietorships, partnerships, and corporations. Each has its own distinct advantages and disadvantages, and the best choice for your business depends on your specific circumstances and goals.

Partnerships can be a great choice for businesses with multiple owners who want to share profits and losses. However, it’s important to note that in a general partnership, each partner is personally liable for the debts and obligations of the business. This means that your personal assets could be at risk if the business runs into financial trouble. In contrast, forming a limited partnership can provide some partners with limited liability, protecting their personal assets from business debts.

Conclusion: Is an LLC Right for Your Business?

Forming an LLC can offer numerous benefits, including limited liability protection and flexibility in management and profit distribution. However, it is important to carefully consider the potential disadvantages, such as self-employment taxes and limited growth potential. Ultimately, the decision to form an LLC should be based on a thorough evaluation of your business’s unique needs and goals. Seeking professional advice can help you make an informed choice and set your business up for success